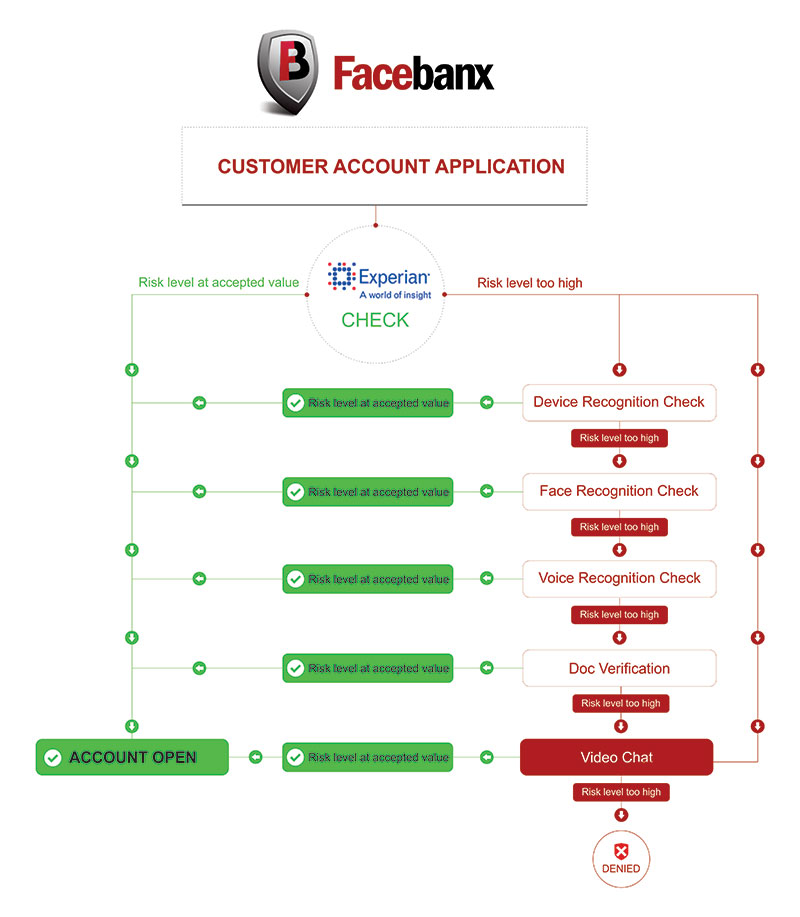

An example of a workflow diagram showing adding additional challenges and video chat.

Many organisations face huge challenges in acquiring new customers to sign up to buy their products, only for them to be rejected due to the limitations built into credit checking or insufficient background checks.

Many of those who are rejected are known to be just the right sort of consumer that marketing departments are looking for, but because they don’t have a credit history they are turned down.

This could lead to unnecessary lost market share.

Facebanx helps resolve this issue and provides the solution to enable acceptance of these customers by performing some simple additional checks that improves the risk/trust score of each customer. By simply adding additional challenges a large proportion of these “lost” customers can be accepted.

Not only does Facebanx’s technology allow for more good customers to be accepted but due to the fact it is all done in real time, there is no need to maintain a high level of staffing in the back-end to maintain these customers. A whole level of “Colleague Workflow” staffing can be done away with thus making significant savings to the bottom line.

Facebanx provides the opportunity to increase the conversion rates of online current account applicants by using two different solutions:

It is possible to adjust the current criteria provided by Credit checking software by asking the customer for a number of additional challenges.

In the workflow diagram above the first suggested check would be device recognition. If the device was recognised as being acceptable, just this additional challenge might be enough to tip the score to an acceptable rate. If not then the next challenge could be made.

The second challenge might be face recognition technology. This would simply entail the customer accepting the request from their devices camera to have their picture taken. This picture would then be compared on your CRM database to make sure that is was a unique face and that it had not been used before. If the face recognition software found no matches then this could change the risk score and the customer could then be accepted.

If not then the customer could also be asked to add their voice print to their account as another biometric marker.

If the risk score, however, were still deemed to be too high, a customer could still be able to continue with their online application within the existing workflow by utilizing document verification software from their device. By using a camera on a device the customer could upload details of their document that could be confirmed in real time and authenticated.

Finally if these extra challenges were still not enough the customer could be asked to enter into a live face to face video chat using the browsers technology so all they would need to do is accept a request and they would start a video chat conversation with a customer service agent from your company. This could be done from a PC, Tablet or mobile device.

The customer could during their application be connected to a customer service agent using video chat who could for instance visually confirm that the customer was in possession of an ID document. The image of the document could be sent in to the agent live by using a scanned in image or by using the camera on a mobile device to send it in whilst still being within the video chat. If the customer sent it in via a device or a jpg the automated ID document software could still be utilized if you did not want an agent to check the authenticity of the document manually.

If the Credit checking software rejected the customer an alternative solution would be to instantly direct them to a face-to-face video chat with a customer service agent. Within the video chat, Facebanx’s software allows for automated document verification, face recognition and voice recognition to be utilised when requested. To reduce the expense of document verification the agent could check the documents manually if chosen to do so.

Facebanx’s proprietary video chat software can be used to replace the need to invite customers to present documents in branch, a request that is often made. By using video chat, customers will be able to apply and complete all requirements from the comfort of their home at a time that suits them.

Facebanx’s solution not only improves customer acceptance rates by avoiding the need to visit in branch, but it also reduces the costs of signing up these customers by deleting the need to utilize any “colleague workflow” staffing as the process will be in real time.

For further information please contact:

Matthew Silverstone

CEO Facebanx

www.facebanx.com

matthew@facebanx.com